In the early 2000s, financial institutions (FIs) made efforts to offer a comprehensive online banking experience, including the capability to make online payments for their consumer markets. While some companies achieved immediate success, they discovered that the American public was not yet fully receptive to online banking. Other companies initially focused on different products but later expanded into the payments sector.

Although PayPal was not the first digital payment platform, it is an example to look at. PayPal emerged as one of the largest players in the field. eBay, in particular, sought a way to expedite item delivery to buyers, surpassing the traditional 3 to 5-day batched ACH payment process. Consequently, eBay acquired PayPal, which facilitated near real-time payments for items and was perceived as more secure due to PayPal’s enhanced control over the payment process. Subsequently, PayPal diversified its services and became one of the world’s leading payment methods.

PayPal’s success did not go unnoticed, prompting other financial institutions to enter the realm of person-to-person (P2P) payments. Zelle, a P2P platform created by a consortium of banks, gained significant recognition and usage. The primary appeal of P2P applications like Venmo and Zelle lies in their user-friendly nature, allowing individuals to send money directly to friends or family members using email addresses or mobile numbers.

The future of digital payments is expected to continue evolving and expanding. With advancements in technology and changing consumer preferences, we can anticipate several trends in this space. We can expect increased adoption of mobile payment solutions. As smartphones become more prevalent and convenient, mobile wallets and payment apps are likely to become the preferred method of payment for many individuals.

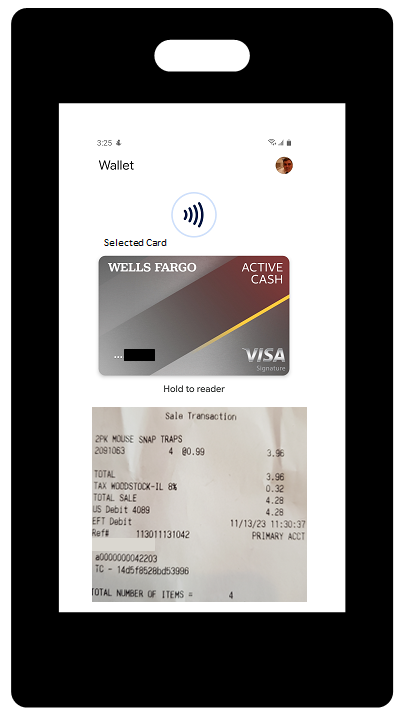

We may see a rise in contactless payments. With the ongoing development of Near Field Communication (NFC) technology, contactless payments using devices such as smartphones or wearables are becoming more widespread. This trend is likely to continue as it offers a convenient and secure way to make transactions.

Currently ACH batch transactions continue to dominate the payments world with billions of ACH transactions running through the Fed and ACH Network per year. The ACH Network enabled real-time payments back in 2017, the Federal Reserve recently introduced its own real-time payment system, FedNow, in July 2023. These are great starts toward enhancing today’s payment systems, allowing for faster end-to-end payments.

As technology continues to advance, the world of digital payments is set to undergo further transformations. With the increasing prevalence of fingerprint and facial recognition technologies, biometric authentication is likely to become a standard feature in digital payment systems, enhancing both security and convenience.

With the innovation of systems like Google’s Bard, you will most likely see a big breakthrough of AI or intelligent payment decisions in your payment devices. Especially from those companies that currently have digital apps on a mobile device such as a cell phone. Imagine the ability to work directly with a POS device from your phone. Things like being able to view the list of items you are purchasing as they are scanned, confirming that purchase, and choosing your payment type on your screen without having to input a card and PIN. Your device should signal you with payment options and provide secure authorization of your payment transaction.

I predict that real time transactions will take place to complete these transactions. For example, after payment authorization is complete the transaction will be sent (obviously encrypted) in some semblance of a JSON message. An example would look something like this:

{

“messageId”: “123456789”,

“sender”: {

“routingNumber”: “123456789”,

“accountNumber”: “987654321”

},

“receiver”: {

“routingNumber”: “987654321”,

“accountNumber”: “123456789”

},

“amount”: 100.00,

“currency”: “USD”,

“paymentType”: “Credit”,

“paymentMethod”: “ACH”,

“transactionType”: “RTP”,

“transactionDate”: “2022-01-01”,

“transactionTime”: “12:00:00”,

“additionalInfo”: {

“description”: “Payment for services rendered”

}

}

In this example, the JSON request includes the necessary information for an ACH Network RTP transaction. It includes the unique messageId for tracking purposes. The sender and receiver objects contain the routing numbers and account numbers of the respective parties involved in the transaction. The amount field specifies the payment amount, while currency indicates the currency of the transaction (in this case, USD). The paymentType is set to “Credit” to indicate a credit payment, and paymentMethod is set to “ACH” to specify the ACH payment method. The transactionType is set to “RTP” to indicate a Real-Time Payments transaction. The transactionDate and transactionTime fields specify the date and time of the transaction. The additionalInfo object can be used to provide any additional details or descriptions related to the payment.

My expectation is that soon, technology will allow you to speak into your IoT devices and may make payments directly from them. As more devices become connected to the internet, the potential for IoT integration in digital payments is vast. Imagine making a payment directly from your bedroom clock or refrigerator.

In conclusion, digital payments have transformed the way we handle financial transactions, offering convenience, speed, security, and accessibility. With various technologies powering these payments and exciting developments on the horizon, the future of digital payments looks promising. Embrace this digital revolution and enjoy the benefits it brings to your financial life!